Many of us are familiar with Singapore’s Goods and Services Tax (GST) rate of 7%. However, GST will increase to 8% on 1 January 2023 and subsequently 9% on 1 January 2024.

It isn’t as clear-cut as it seems. There are many minor details that are complicated. For example, what if you purchase a product before 1 Jan 2023 but it arrives after 1 Jan 2023?

This article will cover the crucial points you should note for this coming GST hike in 2023 and the GST increase in 2024. Moreover, we’ll provide suggestions on what you could buy before the dreaded GST hikes.

Jump ahead to

What Does the GST Increase Mean

Let’s do some quick math. A vacuum cleaner costs $100. A 1% increase in GST means that you will pay an additional $1 after the first GST hike kicks in. Similarly, a $1000 product will cost you an extra $10 after 1 Jan 2023. ($20 more after 1 Jan 2024)

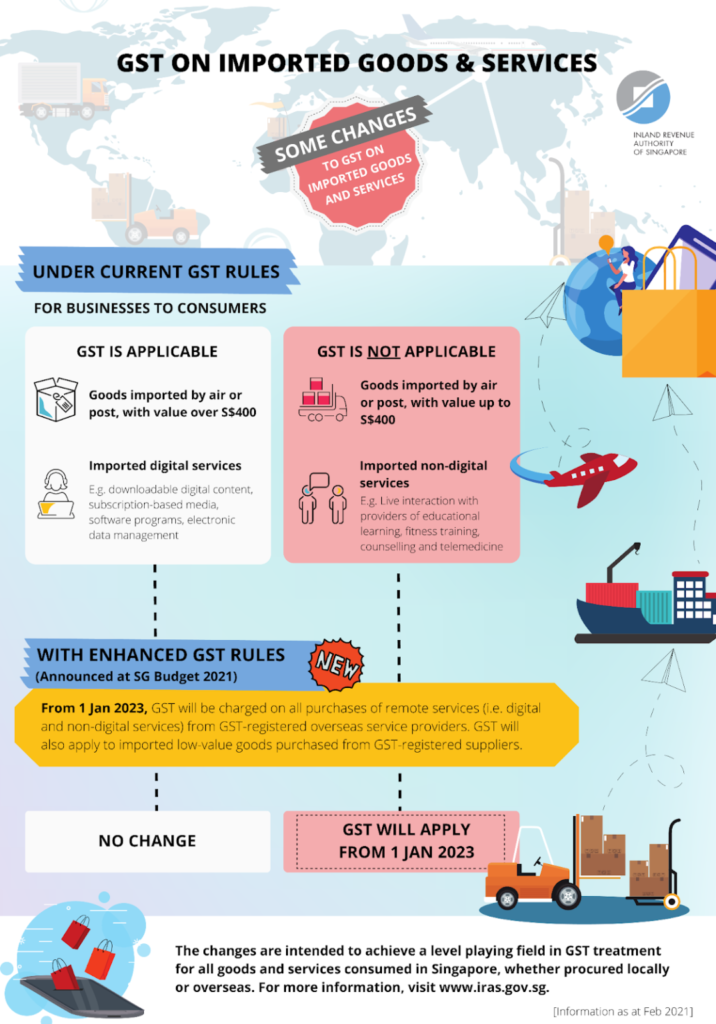

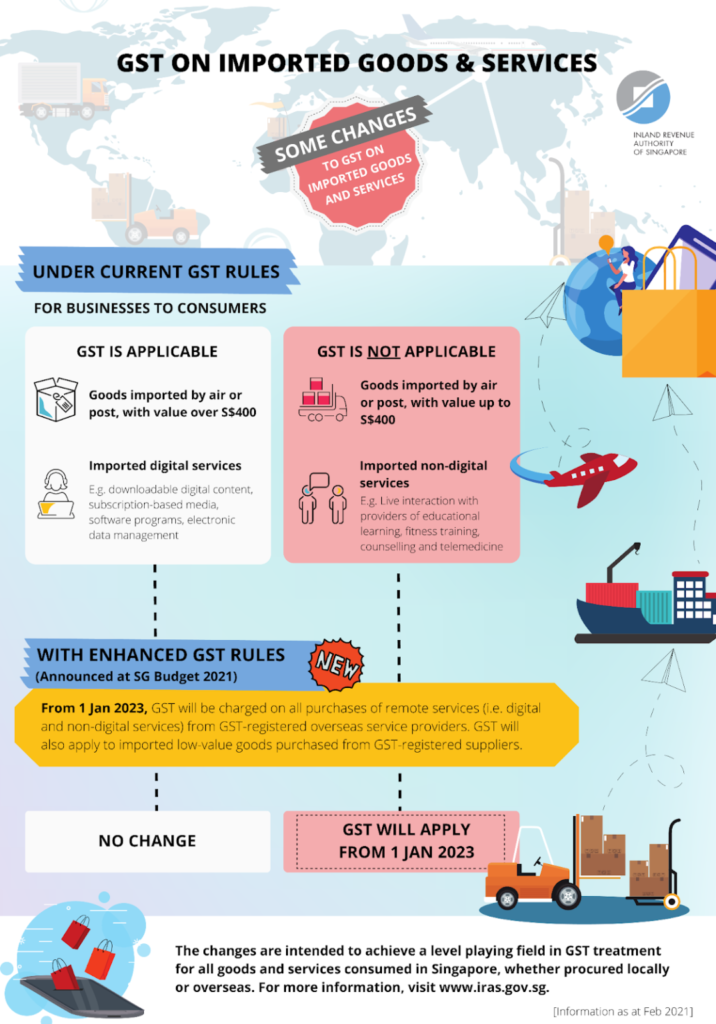

These flowcharts from IRAS may give you some insights into the GST increase.

Image: IRAS GST Rate Change Jan 2023

If you want a detailed breakdown and FAQs on the coming GST increase in 2023 and 2024, you may refer to IRAS’ webpage. They cover what consumers and businesses can expect from the GST rate hike.

Answering the question from before: If you purchase a product now and make full payment before Jan 2023, but the product arrives after 1 Jan 2023, it’ll still be considered 7% GST.

Let’s say you are using pay later/instalment option. There are 2 scenarios.

- You purchase a product that arrives before 1 Jan 2023

- You purchase a product that arrives after 1 Jan 2023

For option 2., Your instalment payment will be subjected to 7% GST before 1 Jan 2023, 8% after 1 Jan 2023. For option 1., Your instalment payment will remain at 7% even after 1 Jan 2023.

If you are like me, you may be thinking, “What to buy before the GST increase?”, or “What to do before the GST increase in 2023 and 2024?”

Well, here are 5 possible things to buy before the GST increase – not just big-ticket items.

5 Things to Buy Before the GST Increase in 2023 and 2024

1. Household Appliances

Image: Marketing to China

Always wanted to buy that robot vacuum? You’ll now have more incentive to do so. If you know that your washing machine is going to break down in the next few months, you may look to invest in a new one before the next GST rate hike.

Look around your house and see if there is anything that needs to be replaced. Telltale signs are exposed wires from the cables of your household appliances or decades-old equipment.

Examples of household appliances to buy before the next GST increase: Air fryer, vacuum cleaner, fridge, microwave, washing machine, etc.

2. Electronics and Gadgets

Image: Tartila

Please don’t buy a new phone if you recently got one. Saving money on GST rate increases aside, we still need to develop healthy saving habits.

So, if your laptop is on its last legs and you need it for work or school, it may be time to search for a new one.

Examples of electronics to buy before the next GST increase: Wireless earbuds, television, camera, phone, laptop, computer, iPad/tablet, mouse, keyboard, etc.

3. Furniture

Image: Architectural Digest

With the prevalence of “work from home”, you may want to spend some money on a good ergonomic chair. Anything that would enhance your productivity would be a great asset in the next few years.

Are springs coming out of your sofa or mattress? Maybe it’s time for a change.

Examples of furniture to buy before the next GST hike: Chairs, tables, sofas, shelves, mattresses, cabinets, etc.

4. Subscriptions and Productivity Software

Image: PCMag

Renewing your subscriptions early is a no-brainer before the next GST rate increase. For subscriptions that you use regularly, you may even opt for yearly plans.

You can also look into prepaying your bills and other expenses, but consider the opportunity cost. Prices for such subscriptions may fluctuate which is another factor to consider.

Examples of subscriptions to buy/renew before the next GST hike: Photoshop, streaming services, gym membership, etc.

5. Household Essentials

Image: Yahoo Finance

Although not the most expensive products out there, a dollar saved is still a dollar earned.

Products that you use on a daily basis can be stocked up but don’t let your house turn into a supermarket!

Examples of household essentials to buy before the next GST increase: Tissue products, ramen, ingredients, sauces, cleaning products, stationery, toiletries, etc.

Bonus: Vehicles and Fashion Products

In terms of big-ticket items, vehicles such as cars and motorcycles may provide the most GST hike savings.

Nonetheless, before buying such big-ticket items, always consider your lifestyle, income sustainability, and goals.

On the other hand, you may look to prepurchase your new year clothing or refresh your wardrobe if you’ve been wearing the same Uniqlo t-shirt for years.

Examples of fashion products to buy before the next GST increase: Wallets, watches, shoes, clothes, accessories, caps, etc.

Opportunity Cost

At the end of the day, a 1% or 2% GST savings still means you spent that however amount on that purchase. It doesn’t matter if you saved $10. You still spent $1000 to get that $10 GST discount.

Rarefyi believes that you should only buy what you need, and occasionally indulge in what you want. Ask yourself if you really need the product before purchasing.

Furthermore, prices of products may be lowered by the merchant after your purchase. You need to consider the opportunity cost of spending money on your purchases which can otherwise be used for other things.

With interest rates rising, fixed deposits, government bonds and treasury bills look attractive. Remember to consider what you may be losing out on if you decide to purchase something.

These may interest you:

- Everything You Need to Know About Investing With Moomoo App

- Is GPA Important? Do This If You Have a Low GPA

- $100k in 2 Years – Sharing What I’ve Learnt to Get There

- How to Win a Writing Competition – From a NYT Competition Winner

- The Reality of Work and How to Avoid Burnout

Conclusion – What to do before GST increase

It was announced in Singapore’s 2022 budget that GST will increase from 7% to 8% from 1 January 2023 and to 9% in 1 January 2024.

Generally, what this means as a consumer or as a business owner is that prices will increase. Hence, you may look into buying some of the items listed above before the GST rate hike.

Another important detail, before 1 January 2023, goods under $400 are exempt from GST. After 1 January 2023, 8% GST will kick in regardless of purchase price.

We hope that you found this article useful. Do consider following us on social media for similar content!

About the Author

Rarefyi is a place where everyone can share their experiences, life stories, tips, mistakes, and advice. Share your story and get featured!